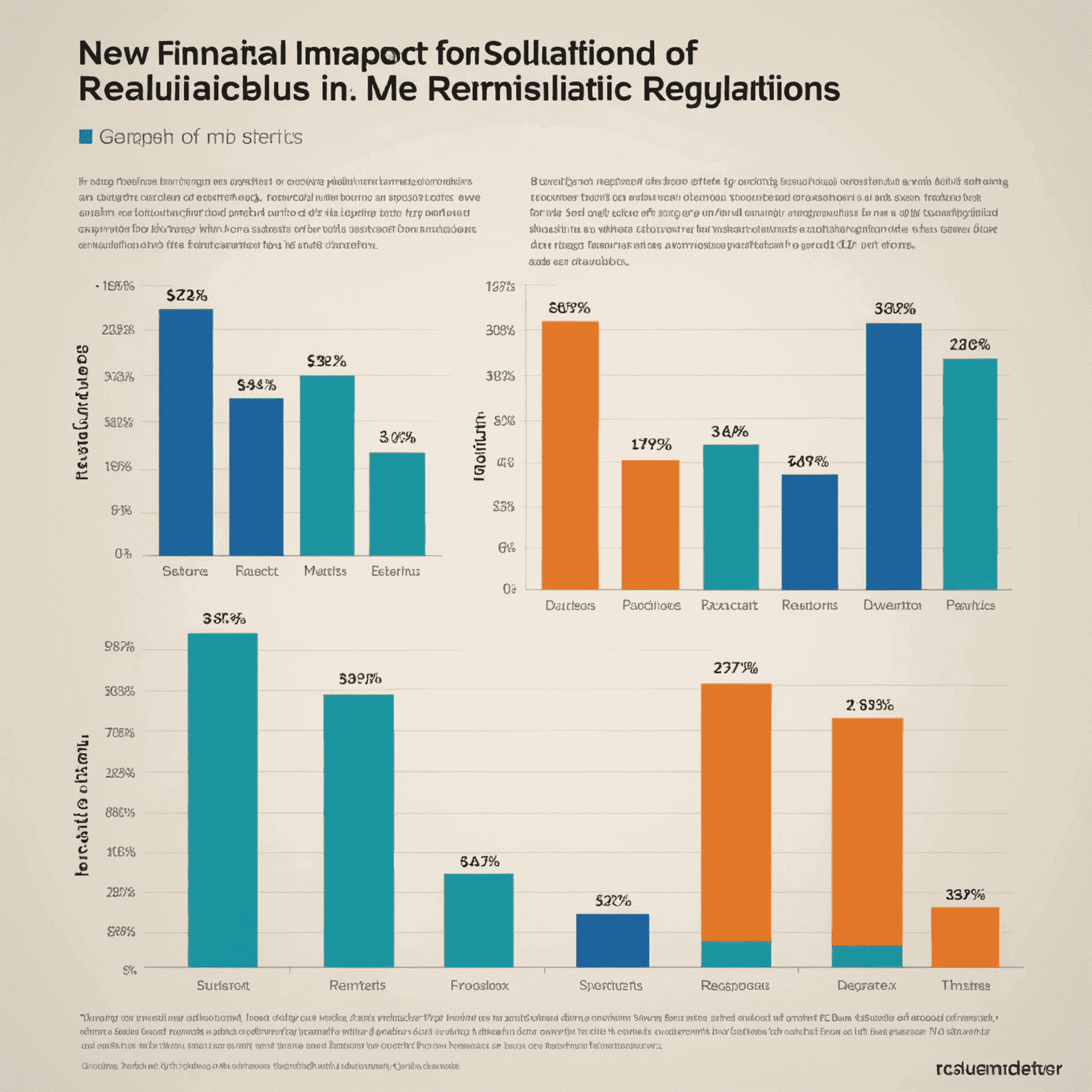

Changes in Legislation and Their Impact on Business

Recent changes in financial reporting regulations have significant implications for businesses across various sectors. This article analyzes the new laws and regulations concerning financial reporting and their consequences for enterprises.

Key Legislative Changes

The government has introduced several amendments to the existing financial reporting framework, aimed at improving transparency and accountability in business operations. These changes include:

- Enhanced disclosure requirements for related party transactions

- Stricter rules on revenue recognition

- New standards for lease accounting

- Updated guidelines for reporting intangible assets

Impact on Businesses

These legislative changes will have far-reaching effects on how businesses manage their financial reporting processes:

- Increased Compliance Costs: Companies may need to invest in new accounting software and training to meet the updated reporting requirements.

- Changes in Financial Statements: The new regulations could significantly alter the appearance and content of balance sheets and income statements.

- Potential for Restatements: Some businesses might need to restate previous financial reports to align with the new standards.

- Impact on Key Financial Metrics: Performance indicators and ratios used by investors and analysts may be affected.

Preparing for the Changes

To navigate these changes effectively, businesses should consider the following steps:

- Conduct a thorough assessment of current financial reporting practices

- Identify areas that require modification to comply with new regulations

- Invest in staff training and education on the new reporting standards

- Consult with financial experts and accounting professionals for guidance

- Update internal control systems to ensure compliance with new requirements

Long-term Implications

While these changes may present initial challenges, they are designed to enhance the overall quality and reliability of financial reporting. In the long run, businesses that adapt successfully may benefit from:

- Improved investor confidence

- Enhanced comparability with industry peers

- Better decision-making based on more accurate financial information

- Reduced risk of regulatory penalties

As the business landscape continues to evolve, staying informed about legislative changes and their impacts is crucial. Companies that proactively address these new requirements will be better positioned to thrive in an increasingly complex regulatory environment.